The IRS Puts High-Income Non-Filers Notice

Withum

SEPTEMBER 21, 2023

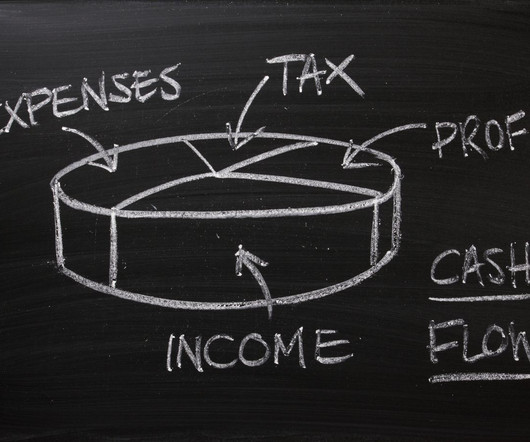

In a recently issued notice, #IR 2023-126, the IRS warns that the government is coming after high-income taxpayers who fail to file a tax return. The IRS discusses how the reduction in agency funding in the past impaired the Service’s ability to track down high-income non-filers and what the recent budget increases have permitted the IRS to accomplish in terms of collecting taxes and even securing criminal convictions.

Let's personalize your content